The Manager intends to use the gross proceeds of approximately S$442.7M from the Rights Issue in the following manner: approximately S$381.6M will be used to part finance the remaining purchase price for Ascott Orchard Singapore. S$56M will be used to fund 2 properties acquisitions in Germany (subjected to Unitholders' approval).

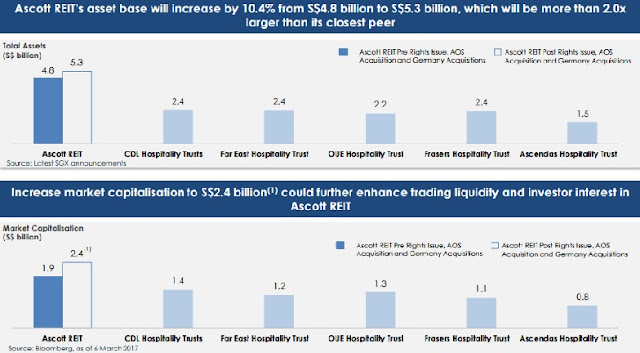

The chart above compares the asset value and market cap between the different hospitality trusts listed in Singapore. Ascott Reit looks pretty impressive compared to the others.

Here's the part which I am not so impress about.

Both the DPU and NAV actually falls after the rights issue and acquisitions. ;(

Decrease in Gearing is good though. Maybe the Management would not issue any rights or private placement for next 2 years.

So what's my verdict?

To be continued ...

No comments:

Post a Comment