The following Post is a brief write-up on what I learnt from CRCT 2016 Annual Report.

Page 6 of the Annual Report shows the Financial Highlights. Compared to 2015, 2016 results have fallen slightly.

Page 8 shows Message from Chairman and CEO to Unitholders. CRCT is already 10 years old this year. It has grown from initial portfolio of 7 properties to the current 11 properties. This results in fourfold increase in Asset Value. Tony Tan has been working very hard.

It was also mentioned in the Message that NPI has been affected by higher tax provision for the Beijing Malls that took effect on 1 July 2016. Strengthening of SGD against RMB further impacted CRCT's distributable income.

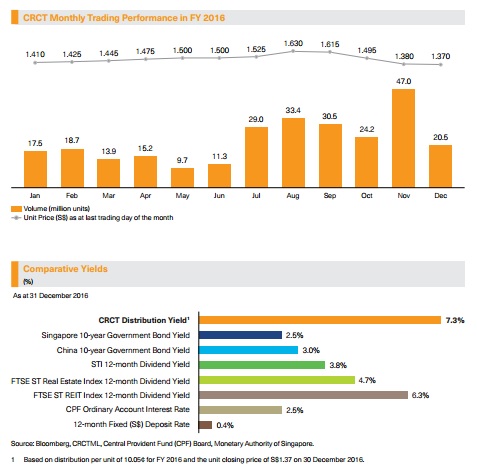

7.3% distribution yield based on closing price of $1.37. Impressive. But what if we had bought CRCT at beginning of 2016 at a $1.50? The yield still works out at 7%. I am confident the returns from CRCT can far outperform the Singapore 10-year Government bond at the end of the 10 year period. The 10-year bond is however suitable for those with lower risk appetite. Why not compare performance with other China Reits instead?

Wow. Mall visits for investors. Include free air ticket and lodging? Where can I sign up?

To be continued . . .

No comments:

Post a Comment